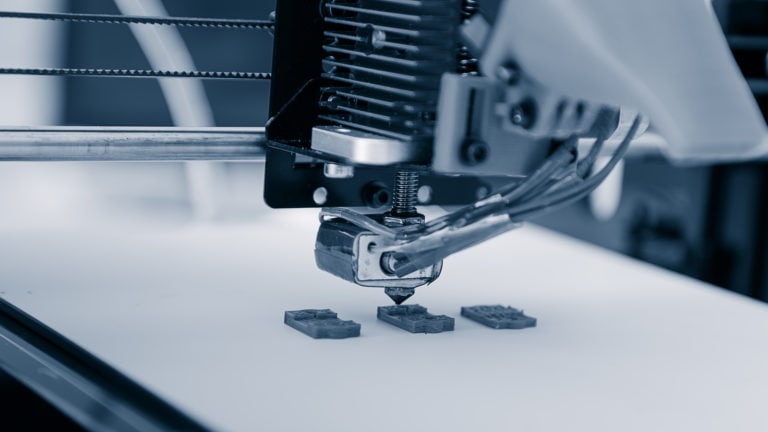

3D printing shares might have misplaced their luster, however these corporations are on the forefront of a software program resurgence

Supply: shutterstock.com/Alex_Traksel

3D printing shares haven’t seen the surge in reputation they as soon as did — buyers acknowledged that the sector is capital-intensive and, whereas the trade matures, low margin. However that’s starting to alter as the highest 3D printing shares pivot away from specializing in {hardware} and start specializing in area of interest, focused software program to maximise present {hardware}’s potential.

Anticipated to hit over $50 billion by 2030, the 3D printing sector is quickly rising whilst investor consideration shifts away from once-popular shares. That creates a novel alternative for buyers (who might have missed the primary run-up) to purchase the very best 3D printing shares at a cut price – however they gained’t stay this low-cost for lengthy.

Altair Engineering (ALTR)

Supply: Pixel B / Shutterstock.com

Altair Engineering (NASDAQ:ALTR) is a mid-cap 3D printing inventory centered largely on offering the software program underpinning product improvement and evaluation earlier than the design strikes to the subsequent step within the 3D printing course of. This evaluation, design and simulation software program suite is especially helpful in advanced engineering duties the place product tolerances are measured in nanometers.

Altair ended 2023 with a bang as a robust fourth quarter compensated for wider sector weak spot in the beginning of the yr. Altair’s fourth-quarter highlights embrace $155.9 million in software program income, of which its 3D printing section is part, greater than 7.5% larger year-over-year (YoY). Likewise, earnings per share hit a decent 22 cents whereas free money stream almost doubled YoY to $19.3 million.

Altair’s year-end report left a bit to be desired, largely as a consequence of early-year financial weak spot. Nonetheless, software program gross sales hit $550 million for the yr, an 8.6% YoY enhance, whereas its web loss narrowed to only $8.9 million in comparison with 2022’s hefty $43.4 million. Regardless of the end-of-year rebound, shares haven’t but fairly hit analyst value targets, averaging $88.71 per share.

Desktop Metallic (DM)

Supply: shutterstock.com/FabrikaSimf

Desktop Metallic (NYSE:DM) falls firmly inside the small-cap and penny inventory territory, buying and selling under $1 per share with a complete market cap of simply $280 million. Nonetheless, regardless of its dimension, this 3D printing inventory has loads of bullish tailwinds, setting it as much as increase quickly.

Desktop Metallic’s healthcare-focused subsidiary, Desktop Well being, just lately unrolled an expansive initiative concentrating on dental professionals. The subscription-based platform, referred to as ScanUp, helps elevate dental practices to the digital age. This section is a surprisingly large market contemplating “half of the dentists in america haven’t but adopted intraoral scanning,” which is the baseline foundational step to dental digitization. This implies Desktop Metallic targets an enormous, untapped market with a recurring income subscription plan that brings in extra cash with higher predictability, because the ScanUp platform requires an preliminary 36-month plan.

Desktop Metals closed 2023 with a a lot narrower, although nonetheless substantial, web lack of $323.4 in comparison with 2022’s $740.3 million loss. Whereas nonetheless racing on the trail towards profitability, Desktop Metallic stays a high-risk however high-reward speculative 3D printing inventory at a value that’s powerful to beat.

Autodesk (ADSK)

Supply: JHVEPhoto / Shutterstock.com

On the opposite facet of the market capitalization spectrum is 3D printing inventory Autodesk (NASDAQ:ADSK), which affords buyers an array of income streams past simply 3D printing to assist diversify threat away from a single sector. Like Altair, Autodesk’s 3D printing instruments let customers design and take a look at fashions digitally. However, not like Altair, Autodesk’s Fusion 360 platform additionally syncs straight with printers to convey the digitized product into the fabric world. On the similar time, Autodesk’s instruments additionally allow subtractive ending (eradicating materials from present objects) to additional refine area of interest engineering and manufacturing merchandise that demand excessive constancy and high quality.

Traders who need to seize a slice of 3D printing’s long-term potential whereas diversifying away threat seen in 3D pure-plays can nearly actually discover one thing to love in Autodesk’s inventory. Autodesk’s software program choices embrace instruments tailor-made to the development, leisure, training and engineering industries — which suggests a large swath of buyer segments leverage Autodesk’s platforms past simply 3D printing fanatics.

On the date of publication, Jeremy Flint held no positions within the securities talked about. The opinions expressed on this article are these of the author, topic to the InvestorPlace.com Publishing Tips.