The stock market is no exception. Everyone loves a good bargain. While picking up items at a sale is simple, buying shares is more complicated.

That’s because a cheap stock often means that it has been through the wringer, and the immediate question that comes to mind is, why have the shares taken a beating?

A stock that has been beaten down may be down due to many different reasons. They could range from fundamental weakness to macroeconomic concerns to investors’ unreasonable behavior. As the saying goes: the trick to buying the dip is to identify the names that have temporarily fallen and will soon rise again.

What are the best ways to find these bargains, though? Wall Street experts could be of help. They are paid to tell you which stocks to buy at any time.

With this as backdrop, we opened the TipRanks database to get the lowdown on two stocks that have witnessed a big drop recently, but which certain Street analysts are recommending investors participate in the time-honored act of “buying the dip” ahead of an anticipated rise. The details are below.

Roblox CorporationRBLX)

We’ll start with a look at a gaming and metaverse company, Roblox. Roblox has been around since the early 2000s, offering users an interactive platform to create, play, and share games – and to interact with each other through them. Roblox calls itself a metaverse, offering its users an experience that is more than what can be found on the internet. The company has combined gaming with community building to foster creativity amongst its user base.

Some numbers will give the scale of Roblox’s operations. Roblox boasted 65.5 millions daily average users who spent collectively over 14 billion hours engaging with the platform. This huge user base makes Roblox one of the world’s top platforms for the under-18 audience. The company’s popularity with its target user base is attributed to its ability develop community between users, gamers, or developers.

Roblox’s recent 2Q23 results showed that the company had increased its top line. Revenues were $680.8 millions, a 15 percent increase over the previous year.

Some results were less impressive. The net-loss earnings per share of 46 cents were less than expected, but still better than the 30 cents from 2Q22. The company generated $38 in adjusted net EBITDA while reporting $780.7 million of bookings.

Analysts expected a different result. The analysts expected EBITDA at $46m and bookings of $785m. RBLX shares have fallen 23% in the last month after the earnings announcement.

For Wedbush analyst Nick McKay, the key points here are Roblox’s strong position and user base, combined with a lowered price that gives investors an attractive entry point. McKay writes of Roblox, “Q2:23 results brought light to some soft spots within the company, but we think that the data trackers, seasonality, and stubbornness contributed to the misses. Roblox has the most impressive growth trajectory of all the video game brands in our coverage universe, after considering its size and number of users, new products, as well as the potential to reconsider its approach to profit.

“With Roblox shares trading well below our price target after a selloff, the risk/reward profile has become favorable to the upside… We expect patient investors to be rewarded by continued topline growth coming from the expansion of key user metrics, a slew of new product introductions, and a more aggressive approach to cost control in future periods,” McKay went on to add.

McKay’s rating for RBLX is Outperform (a buy), with a price target of $37, implying an annual gain of 24%. (To watch McKay’s track record, click here)

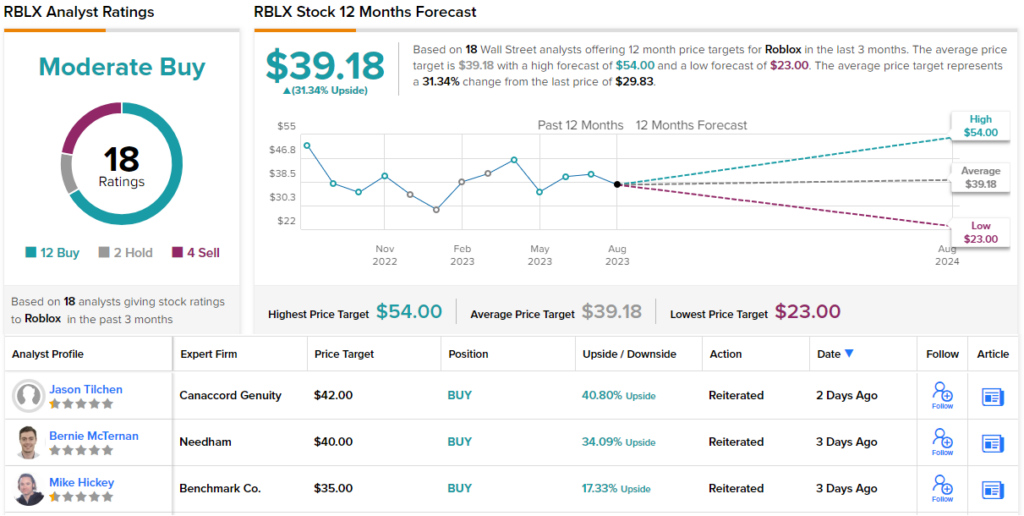

The Street is also generally bullish on Roblox. There are 18 recent reviews, which break down into 12 Buys (with 2 Holds), 4 Sells (4) and a Moderate Buy (consensus). The average $39.05 price target and $29.83 price combine for a 31% upside in the coming year. (See Roblox stock forecast)

Kornit Digital (KRNT)

Kornit Digital is next, bringing high tech and textiles to the forefront. It is a digital printing company with a specialization in industrial-grade, high-speed ink jet technology. The company also produces pigments, other chemicals, and other products. These are used in a range of textile industries, including garments, apparel, home goods, and decorating; Kornit’s printing machines can translate complex designs from the computer directly onto the fabric and the finished fabric products, allowing textile workers to call up patterned products on demand.

Textile artists, makers and factories can streamline operations by creating patterned products on demand. They are able to reduce their inventory space and eliminate redundant processes. Kornit’s customers can use the technology to support direct-to-garment solutions for a more sustainable fashion industry, that generates less waste and overproduction, and produces a seamless experience to ensure that customers will return.

Kornit is a leader in its market, but the stock has fallen 27% in August. The company’s losses have come in the days after its August 9 release of the 2Q23 financial numbers. Kornit reported a net-negative earnings per share for the sixth consecutive quarter, though its non-GAAP loss of 15 cents per share was better than expected. At the top line, the company’s revenues disappointed, coming in at $56.2 million, down 3.3% y/y and more than $550 million below the forecast. The revenue miss fed into the share price drop as did a forward 2H revenue guide that came in 7% below Wall Street’s forecast.

When it’s all said and down, Morgan Stanley analyst Erik Woodring believes that Kornit’s share price loss is investors’ gain, as it opens up the stock for opportunistic buying. Woodring takes note of the headwinds, but states that the company has plenty of room for growth, writing, “We are looking past the near-term challenges to what we believe should still be a year of robust growth in 2024, and continue to forecast high 20% Y/Y revenue growth in CY24 (+26% Y/Y vs. +28% Y/Y previously), albeit off a lower 2023 starting base. At a 3.0x target EV/Sales multiple, we are implying KRNT’s shares still trade at a slight discount to its 2015-2019 valuation when the company was compounding revenue at double digits given the risks associated with the weak near-term spending environment. These factors combined are a concern [are] driving our upgrade to Overweight.”

This upgrade from Underweight (Sell) to Overweight(Buy), accompanied with a price target of $29, indicates confidence that a 26% increase is expected over the next twelve months. (To watch Woodring’s track record, clickhere)

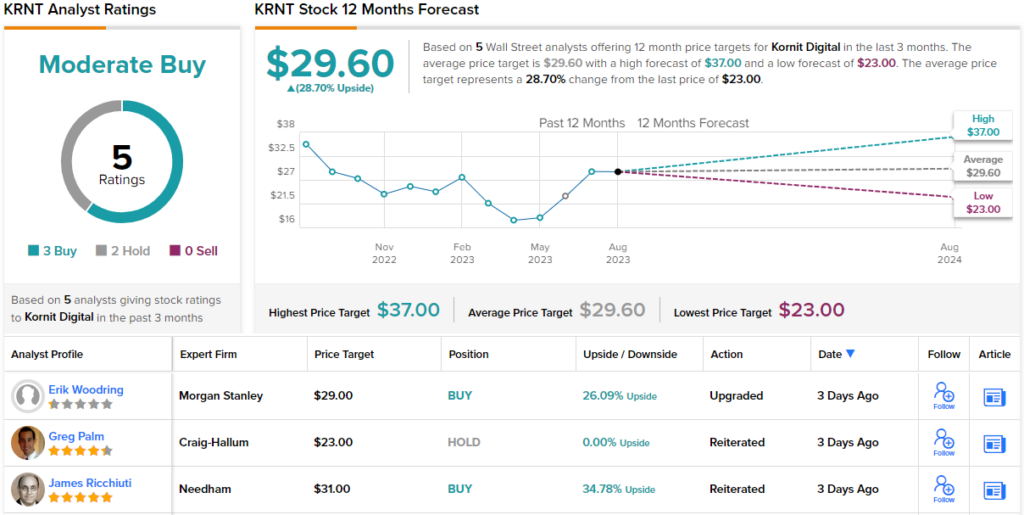

We can see from a wider perspective that Kornit’s recent shares reviews are 3 Buys with 2 Holds. This supports a Moderately Strong Buy rating. The shares are currently trading at $23 with an average price target of $29.60. This represents a 29% rise from the current level. (See Kornit Stock Forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: This article is solely the opinion of the analysts featured. This content is only intended for informational use. You should always do your own research before investing.