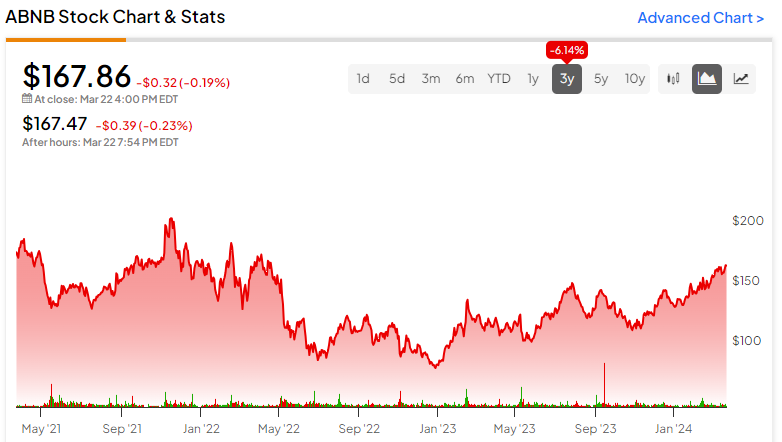

Airbnb inventory (NASDAQ:ABNB) has reworked right into a cash-printing machine backed by sturdy income development and its profitable, high-margin enterprise mannequin. As one of many main reserving platforms favored by vacationers looking for distinctive lodging, in addition to one-of-a-kind experiences, Airbnb maintains its momentum, steadily broadening its model attain. Final 12 months’s outcomes illustrated this theme, whereas consensus estimates level to this development lasting for years to come back. Thus, I stay invested and bullish on ABNB inventory.

Journey Business Momentum Drives Prime and Backside-line Positive factors

Fiscal 2023 was a powerful 12 months for Airbnb, with the journey business’s sturdy momentum driving sturdy high and bottom-line positive factors. One would assume that following 2021-2022’s revenge journey post-pandemic interval, the journey business would take a breather. Nevertheless, the post-pandemic restoration momentum remained sturdy final 12 months, extending business positive factors.

Particularly, based on Eurostat, in 2023, the variety of nights booked in Europe grew by 171 million or 6.3% in contrast with 2022, pushed by notable development in each worldwide and home vacationers. The truth is, the approximate variety of nights spent at vacationer lodging through the 12 months reached 2.92 billion within the continent. This surpassed the pre-pandemic 2019 degree of two.87 billion by 1.6%, setting a brand new file 12 months. Globally, Statista reported that the scale of the worldwide tourism market grew by almost 14% final 12 months.

Being the world’s second-most visited lodging and resort platform, solely behind Reserving Holdings (NASDAQ:BKNG) Reserving, Airbnb loved an natural tailwind from the journey business’s sturdy traction. This led to Airbnb recording vital development throughout its key metrics and general financials.

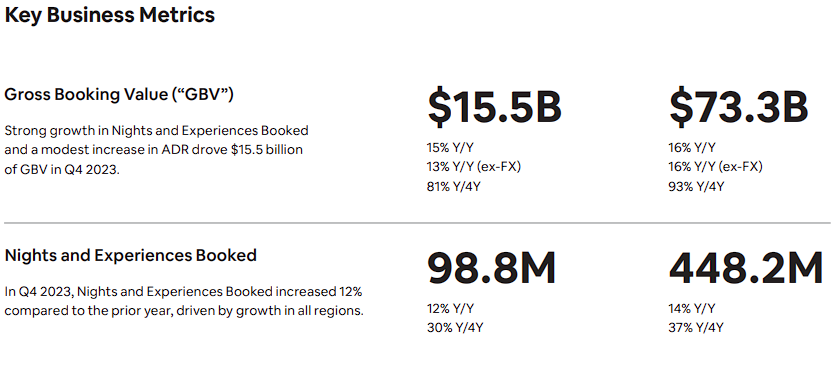

Particularly, nights and experiences booked grew by 14% to 448.2 million for the 12 months, pushed by development in all areas. This development, mixed with greater common costs on nights and experiences, led to Airbnb posting gross reserving worth (GBV) development of 16% to $73.3 billion.

Airbnb’s take fee on this quantity was comparatively steady year-over-year (14.3% in This fall, for context), so the expansion in GBV and a tender however favorable forex translation led to complete revenues rising by 18% for the 12 months to $9.9 billion.

What I really like about Airbnb’s enterprise mannequin is that it’s extremely lean and capital-light, which means that the corporate can obtain super margins. The extra Airbnb scales its revenues, the upper its margins go, particularly given administration has targeted intently on controlling bills in latest quarters.

Certainly, adjusted EBITDA in 2023 landed at $3.7 billion, implying an adjusted EBITDA margin of ~37%, up from final 12 months’s ~35%. Airbnb’s adjusted web revenue (which excludes some notable positive factors recorded in 2023 that inflated GAAP web revenue) additionally had a powerful margin of about 29%.

However, observe that the entire reserving/reservations enterprise mannequin could be very a lot a cash-flow enterprise mannequin. Because of this, I consider that Airbnb will be higher assessed by its free money stream. That is the place the enterprise actually shined, posting a file free money stream of $3.8 billion, up from $3.4 billion final 12 months, implying an enormous free money stream margin of 39%.

Double-Digit Development to Persist For Years To Come

Airbnb’s double-digit development seems poised to persist for years to come back. For my part, it will maintain the inventory’s bullish sentiment.

So far as this 12 months goes, administration acknowledged that 2024 began sturdy and expects revenues in Q1 to land between $2.03 billion and $2.07 billion, implying year-over-year development of 12% to 14%. Primarily based on this and the journey business’s ongoing momentum, consensus estimates level towards Fiscal 2024 revenues of $11.08 billion, suggesting a year-over-year improve of 11.8%.

Impressively, Airbnb’s consensus income estimates forecast double-digit income yearly all through 2033. Positive, after just a few years, projecting revenues turns into extremely speculative. Nonetheless, this reveals the present sentiment, which ought to provide you with an thought of how the market feels concerning the firm’s development prospects.

Moreover, free money stream development is anticipated to observe go well with and land at $4.04 billion and $4.62 billion in 2024 and 2025, charting an analogous trajectory. Subsequently, the corporate seems set to continue to grow quickly and printing money for years to come back.

Is ABNB Inventory a Purchase, In keeping with Analysts?

Relating to Wall Road’s view, Airbnb has gathered combined emotions. The inventory encompasses a Maintain consensus score based mostly on 5 Buys, 19 Holds, and 4 Sells assigned up to now three months. At $144.80, the common Airbnb inventory worth goal implies 13.7% draw back potential.

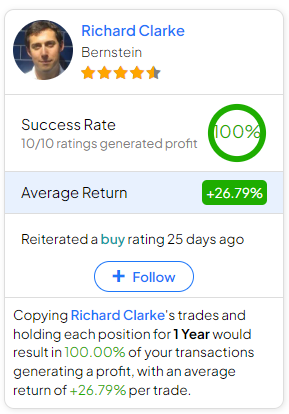

In case you’re not sure which analyst it’s best to observe if you wish to commerce ABNB inventory, probably the most correct analyst overlaying the inventory (on a one-year timeframe) is Richard Clarke from Bernstein. He boasts a mean return of 26.79% per score and a 100% success fee. Click on on the picture under to be taught extra.

The Takeaway

To sum up, I consider that Airbnb’s rise as a cash-generating machine is plain. With a enterprise mannequin that thrives organically on the again of the journey business’s development mixed with juicy margins, Airbnb’s free money stream era prospects are actually fascinating.

Additional, Wall Road predicts double-digit income and free money stream development extending far into the long run, suggesting that the inventory’s funding outlook stays promising. In gentle of this, I’m feeling assured about sticking with Airbnb inventory for the long run and staying optimistic about its long-term story.

Disclosure